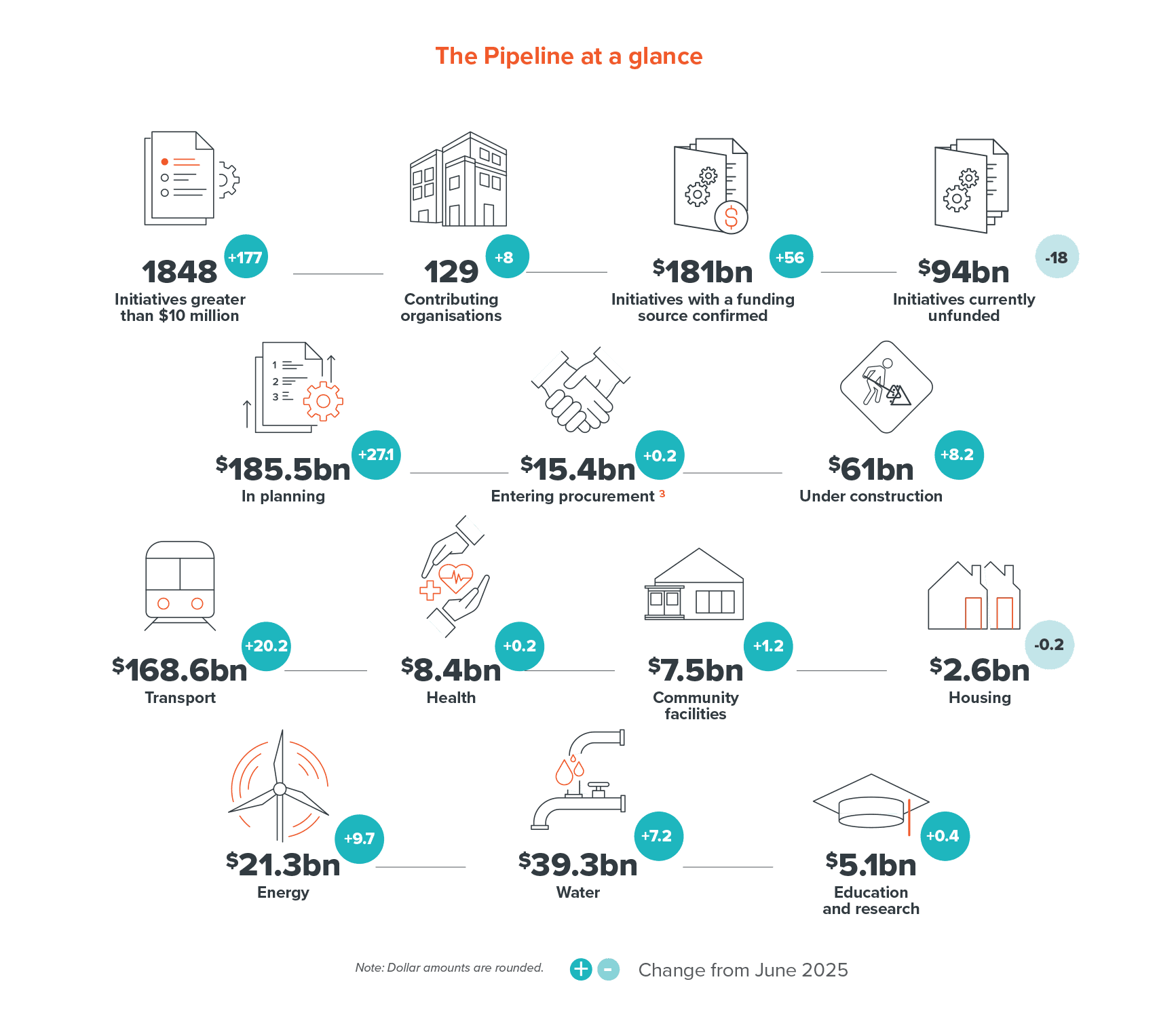

The Pipeline at a glance

The National Infrastructure Pipeline (Pipeline) is New Zealand’s national dataset of infrastructure initiatives providing transparency on investments and activity to maintain, renew, and improve the infrastructure we all rely on. This important evidence base is updated quarterly and includes thousands of projects and programmes at various stages of planning, commitment, and delivery from central government, local government, and private sector infrastructure providers.

Projects advancing and information improvements lead to $56 billion increase in recorded Pipeline value for initiatives with confirmed funding sources

The September 2025 Pipeline update1 included $181 billion of initiatives underway and in planning which were reported as having full funding, part funding or a confirmed funding source. This value represents an increase of $56 billion relative to the June 2025 Pipeline update, which included $125 billion of initiatives with the same funding status. The value of initiatives reported as fully funded increased by $16.1 billion, with $10.9 billion of this attributed to projects in the Pipeline advancing through planning to firm funding commitments. In total, $28 billion of initiatives changed funding status from having no funding source confirmed in June to having a funding source confirmed in September. NZTA adjustments to the funding status of Roads of National Significance (RoNS) initiatives were a major contributor.

The Pipeline also includes initiatives that are earlier in the planning cycle without confirmed funding sources. These initiatives highlight important activity in the system, helping to signal potential demand, highlighting market constraints and opportunities, and supporting investment in capability including developing the workforce New Zealand needs. This information supports the construction industry and infrastructure providers to coordinate and inform their planning.

The combined value of all initiatives in the Pipeline, regardless of funding status, is $275 billion. This total value represents an increase of $38 billion, up from $237 billion in June. This increase improves the transparency of initiatives that are underway and in planning and is driven by improvements in the number of reported initiatives and the quality of submitted information. A clear view of committed investments and options to invest that will seek funding (representing opportunity costs if they remain unfunded) is important to inform funding decisions.

We note that following our September update process, some significant initiatives such as the NZTA's RoNS programme have progressed in commitment or through funding announcements, and this new information will not be reflected in the figures in this report.

Download this snapshot

Pipeline snapshot - September 2025

Informing the National Infrastructure Plan

Information submitted in the September quarter Pipeline update is informing insights in the National Infrastructure Plan (Plan) currently being finalised The Plan will provide forward guidance on a sustainable investment path for infrastructure, insight into large Pipeline initiatives that are unfunded and in planning and a range of recommendations to improve the infrastructure system.

The Pipeline continues growing toward a complete picture of regional and sectoral infrastructure investment activity. This sentiment is endorsed by the Minister for Infrastructure who wrote letters to council mayors and chairs (co-signed by the Minister for Local Government) requesting all councils and council-controlled organisations with a role in infrastructure to regularly update the Pipeline with their investment intentions.

Infrastructure providers yet to contribute information to the Pipeline should reach out to the Commission to learn more about providing data: pipeline@tewaihanga.govt.nz.

Total expected cost of initiatives with committed funding or a funding source confirmed is $181 billion

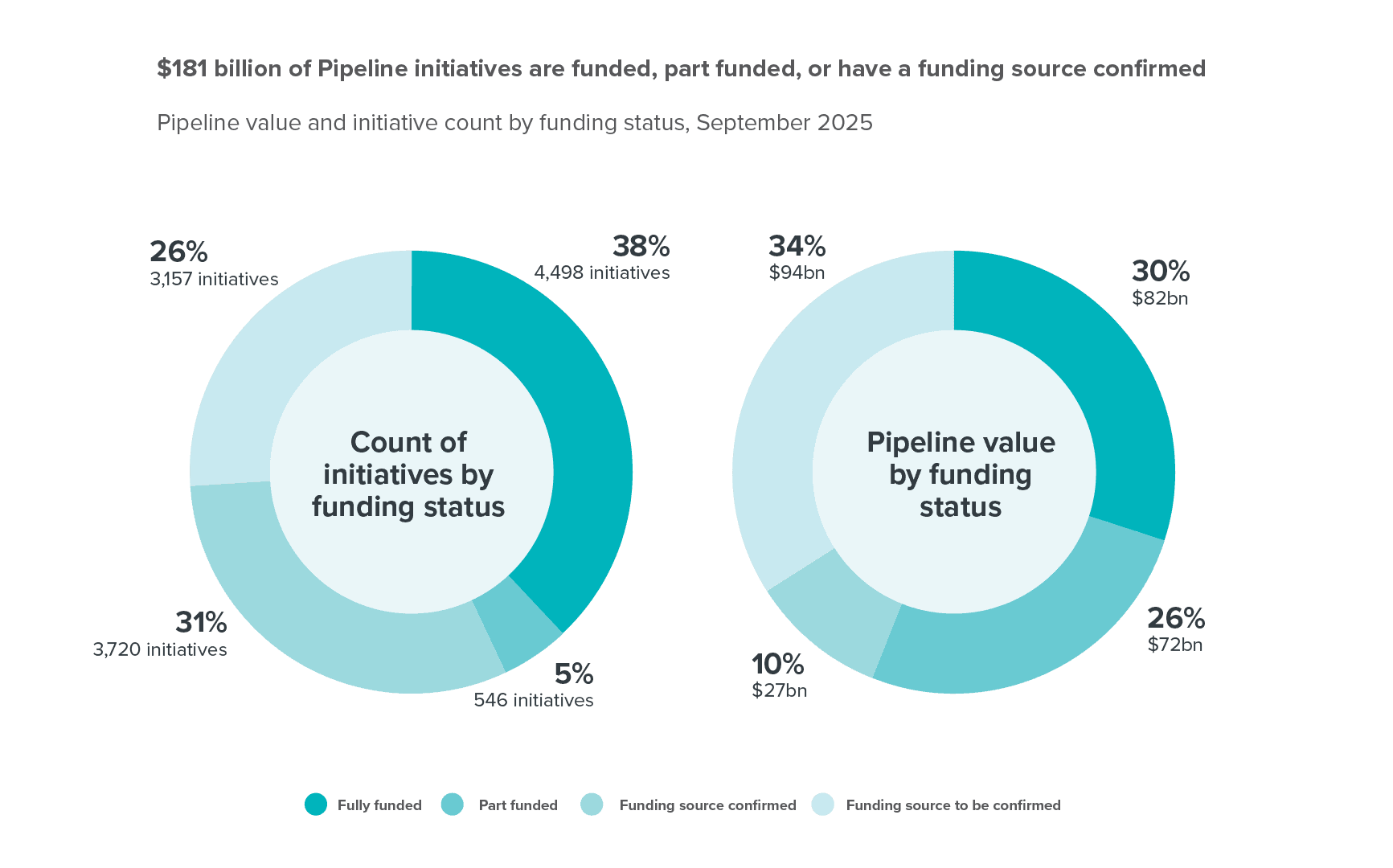

In September 2025 the Pipeline included information on almost 12,000 infrastructure initiatives underway and in planning for 139 infrastructure providers. These initiatives span projects and programmes at various stages of planning, funding commitment, and delivery.

- Fully funded initiatives have funding commitment to complete the initiative up to an approved budget and scope (including initiatives currently in delivery).

- Part funded initiatives vary in the level of funding commitment, from an initial or small commitment, through to a significant (but not full) amount.

- Funding source confirmed indicates an initiative’s future funding source is known, but funding has not yet been committed.

- Funding source to be confirmed indicates when an initiative’s future funding source is not known or has not been confirmed.

The view provided through the Pipeline of committed investments and unfunded investment options (and opportunity costs) is important to inform funding decisions. We are working with providers to enhance the reporting of funding status to provide more clarity, especially in terms of part funding.

Figure 1 highlights the funding status for initiatives in the Pipeline by value and initiative count.

Over 2,500 initiatives are in delivery

Over 2,500 initiatives with a total expected cost of $61 billion were reported as under construction in September. Our modelling indicates work to progress the delivery of these initiatives will result in $2.7 billion spend from 1 October until the end of 2025, and a further $11.5 billion of spend in 2026 as delivery of the initiatives continues.

September shows an increase in initiatives with reported funding commitments

The total value of initiatives with full funding is now $82 billion, a net increase of $16.1 billion from $65.9 billion in June. Almost $15 billion of initiatives with full funding accounts for projects that are yet to enter construction.

Drivers of the $16.1 billion net increase included:

- $8.3 billion additional value from new fully funded initiatives being submitted to the Pipeline

- $10.9 billion additional value from initiatives that progressed in funding commitment between quarters or were reported to the Pipeline with an updated funding status of ‘fully funded’ in September:

- $2.6 billion had previously been recorded as ‘Part funded’

- $6.8 billion had previously been recorded as ‘Funding source confirmed’

- $1.5 billion had previously been recorded as ‘Funding source to be confirmed’

- Balancing the net change were initiatives that closed or were reported with other adjustments.

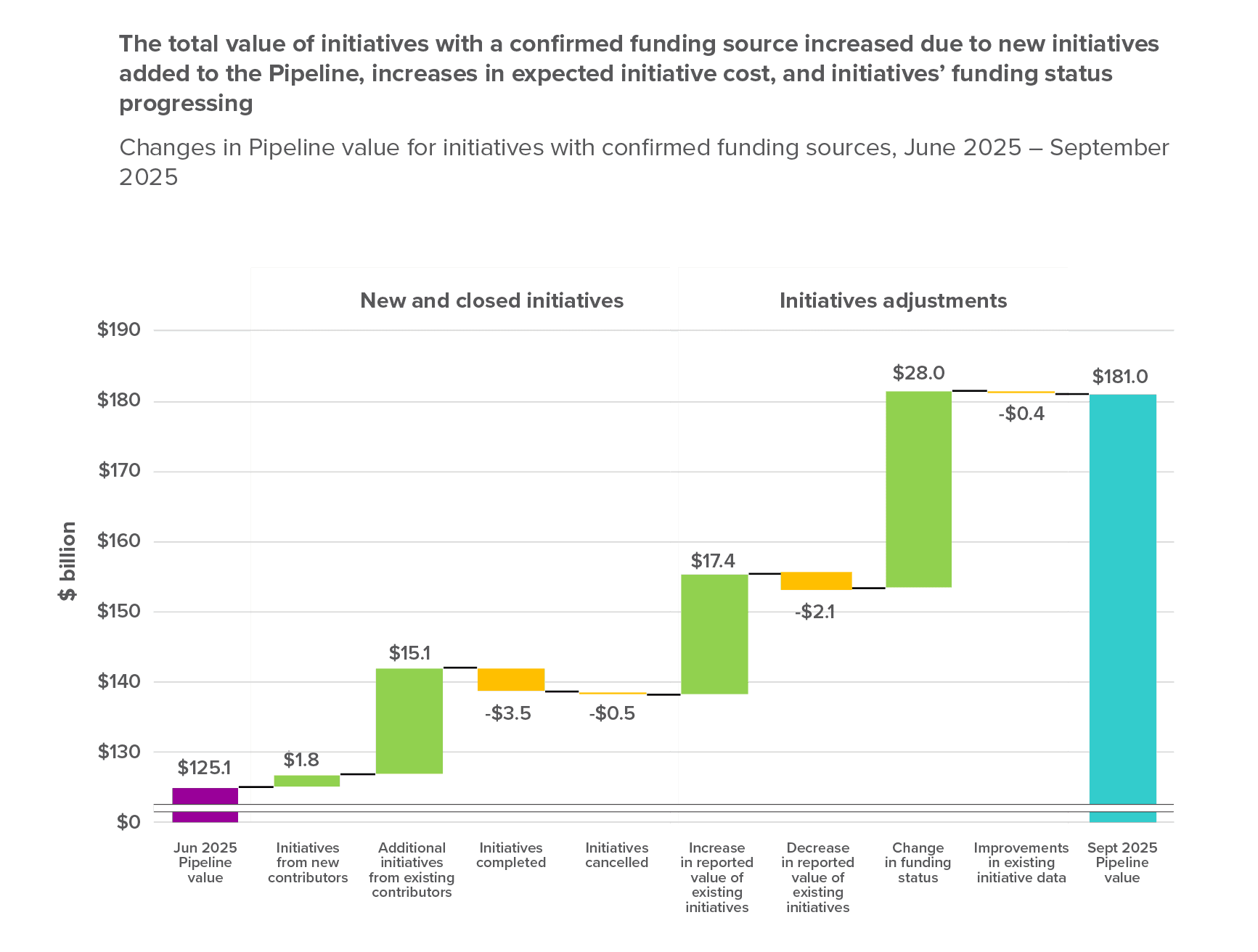

The combined value of initiatives reported as fully funded, part funded or with a confirmed funding source was $181 billion, up $56 billion from June 2025. The drivers of this increase are discussed later the report and shown in Figure 9.

Initiatives without a confirmed funding source had a total value of $94 billion, down $18 billion from June 2025 2.

The combined value of all Pipeline initiatives, regardless of funding status is $275 billion, this includes $5.5 billion of initiatives (2% of total Pipeline) reported as ‘on hold’ or ‘under review’.

Figure 1

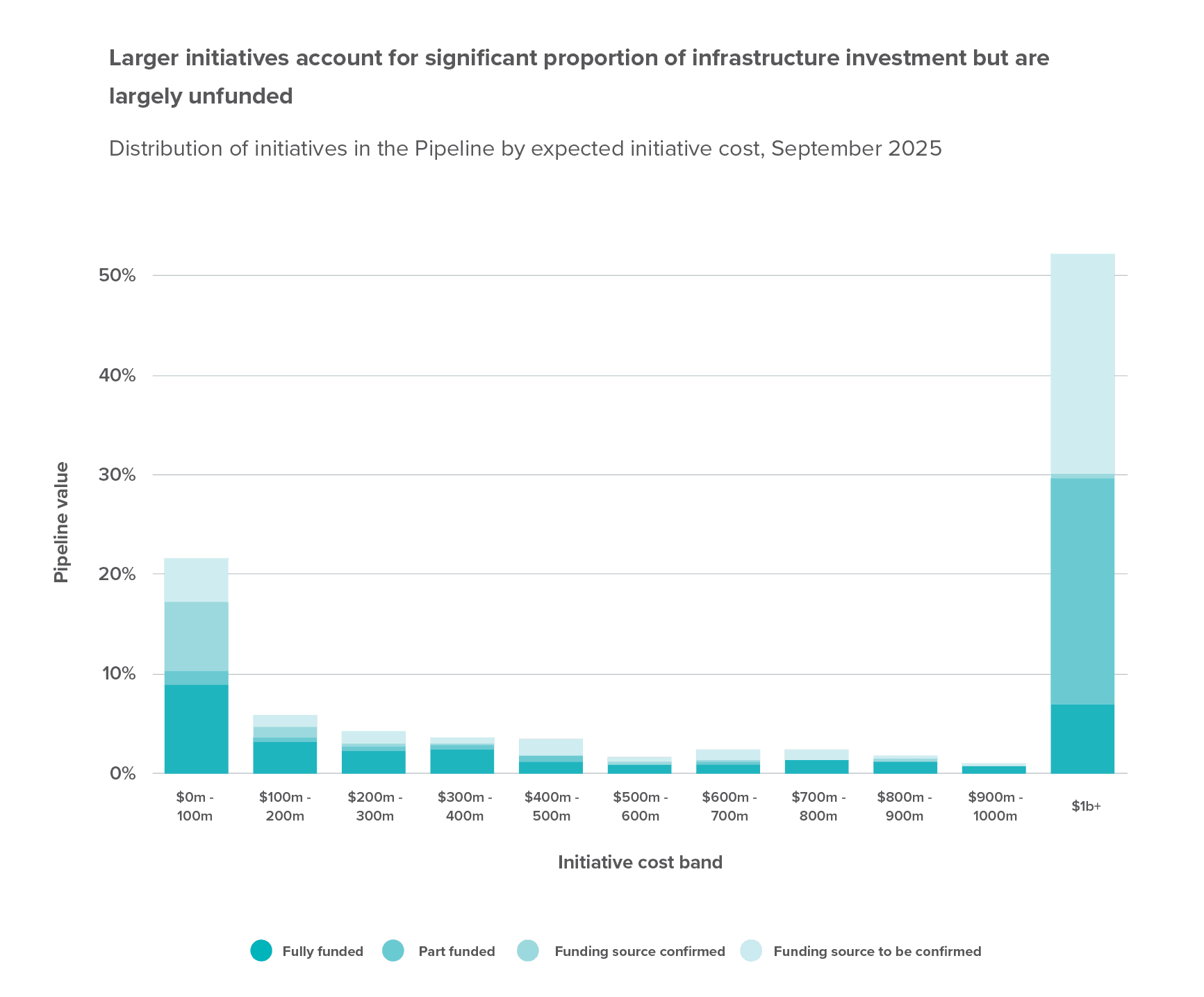

Figure 2 shows the distribution of initiatives in the Pipeline by cost scale and funding status. The figure highlights that 21% of total Pipeline value comes from 11,624 initiatives, that are each expected to cost below $100 million and account for 98% of all Pipeline initiatives. Breaking this down into smaller initiatives shows that 4,591 initiatives or 39% of all Pipeline initiatives have reported expected costs of between $1 and $25 million, and 6,405 initiatives or 54% of all Pipeline initiatives) have reported expected costs of less than $1 million.

Smaller projects and programmes make an important contribution to achieving stability and confidence in the forward works programme, with 72% of the 11,624 initiatives with expected costs under $100 million reported as having a confirmed funding source (17% of total Pipeline value).

At the other end of the scale, the Pipeline currently includes 44 initiatives with expected costs over $1 billion. While these initiatives account for 52% of total Pipeline value, many remain in early stages and represent investment choices for New Zealand. Ten of these initiatives or 7% of total Pipeline value are reported with full funding. A further 17 initiatives or 23% percent of total Pipeline value are reported with part funding.

Figure 2

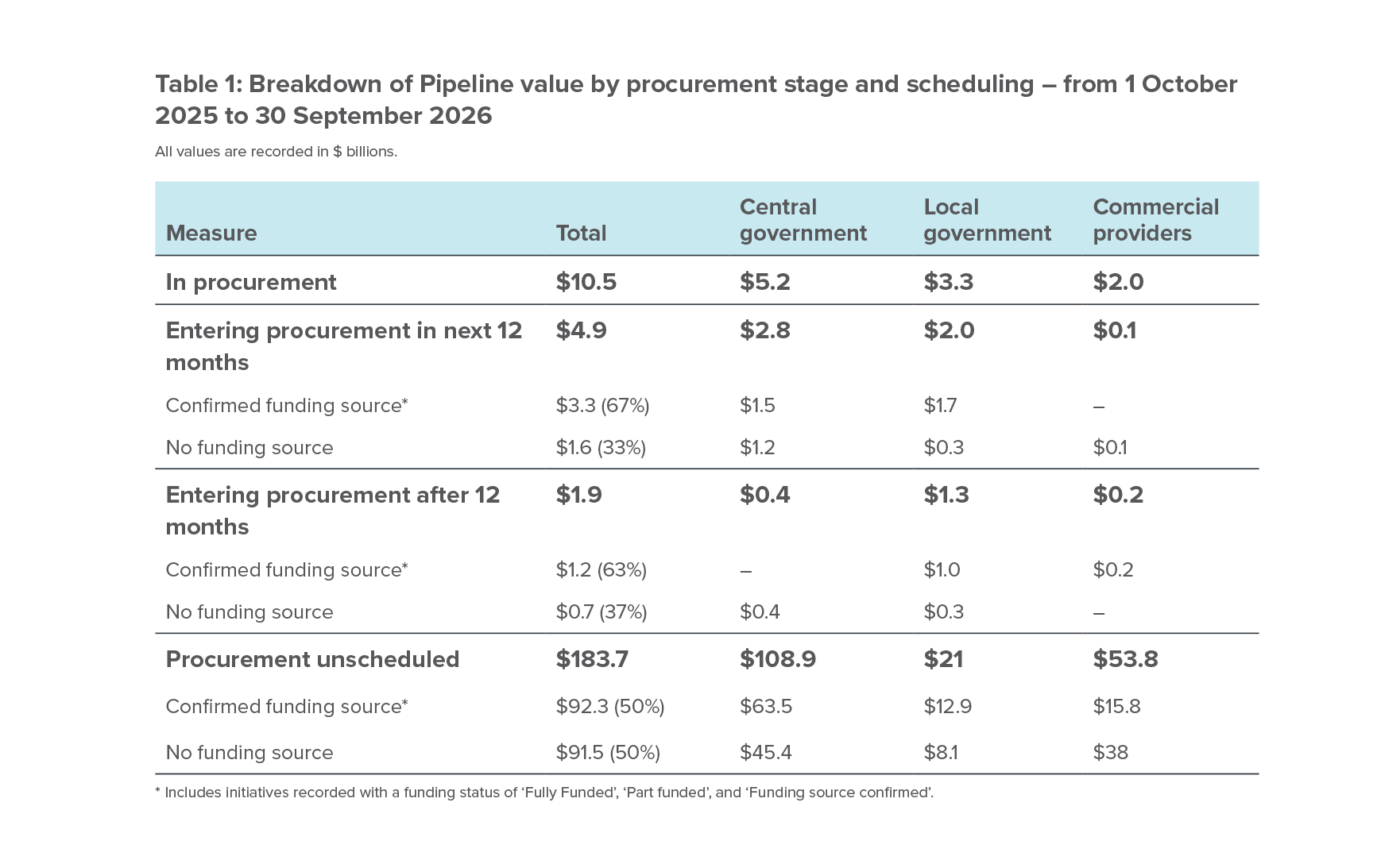

Initiatives entering procurement

Table 1 shows the total expected cost of initiatives that were in procurement at the time of the Pipeline update as well as the expected cost of initiatives that have not entered procurement. Many contributors have not yet provided procurement timing for their initiatives. This means near term procurement opportunity indicated below is likely to be understated.

Table 1

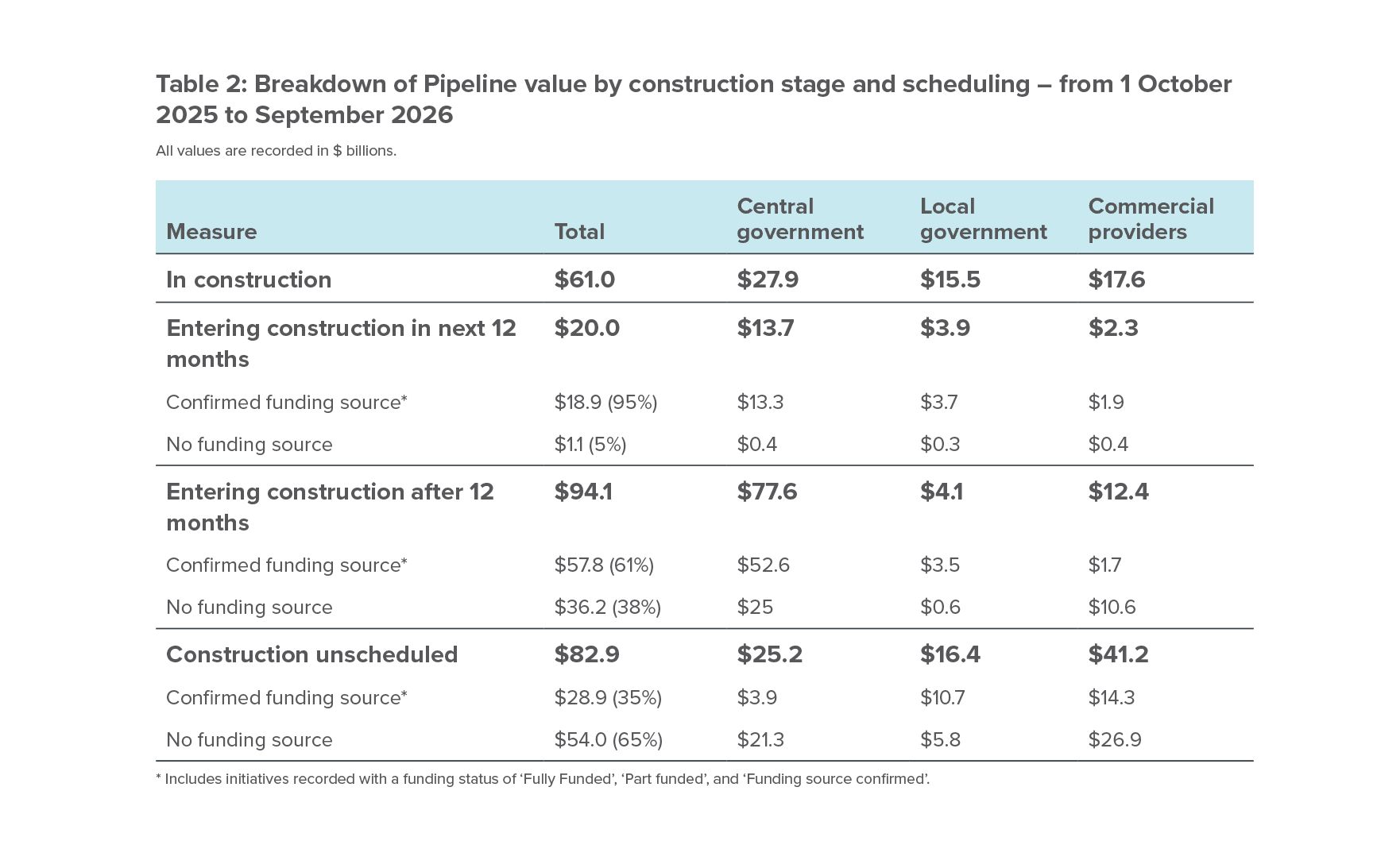

Initiatives entering construction

Table 2 shows the total expected cost of projects in the Pipeline that were under construction at the time of the update and the expected cost of initiatives that yet to enter construction. The table highlights the progression of funding commitment with the majority of near-term activity having funding source confirmed whereas for unscheduled construction funding source has not been confirmed

Table 2

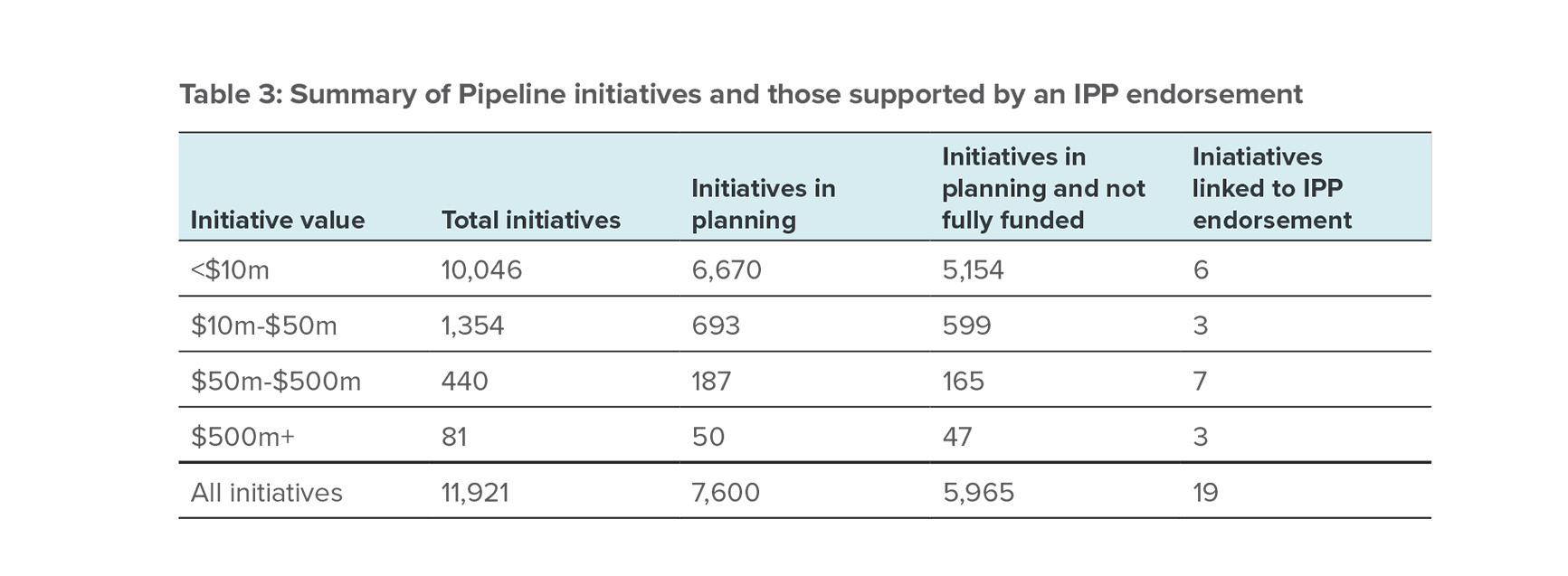

Table 3

Infrastructure priorities

Table 3 highlights there are 19 Pipeline initiatives that are linked to successful proposals endorsed at one of three stages by the Commission’s Infrastructure Priorities Programme (IPP). The IPP undertakes independent standardised assessments of unfunded infrastructure proposals to evaluate strategic alignment, value for money, and deliverability. Results from assessments of applications to round two of the programme are scheduled to be released in December. Any endorsed proposals will be integrated into the Pipeline’s forward view of infrastructure activity and track these as they progress.

Projected spend

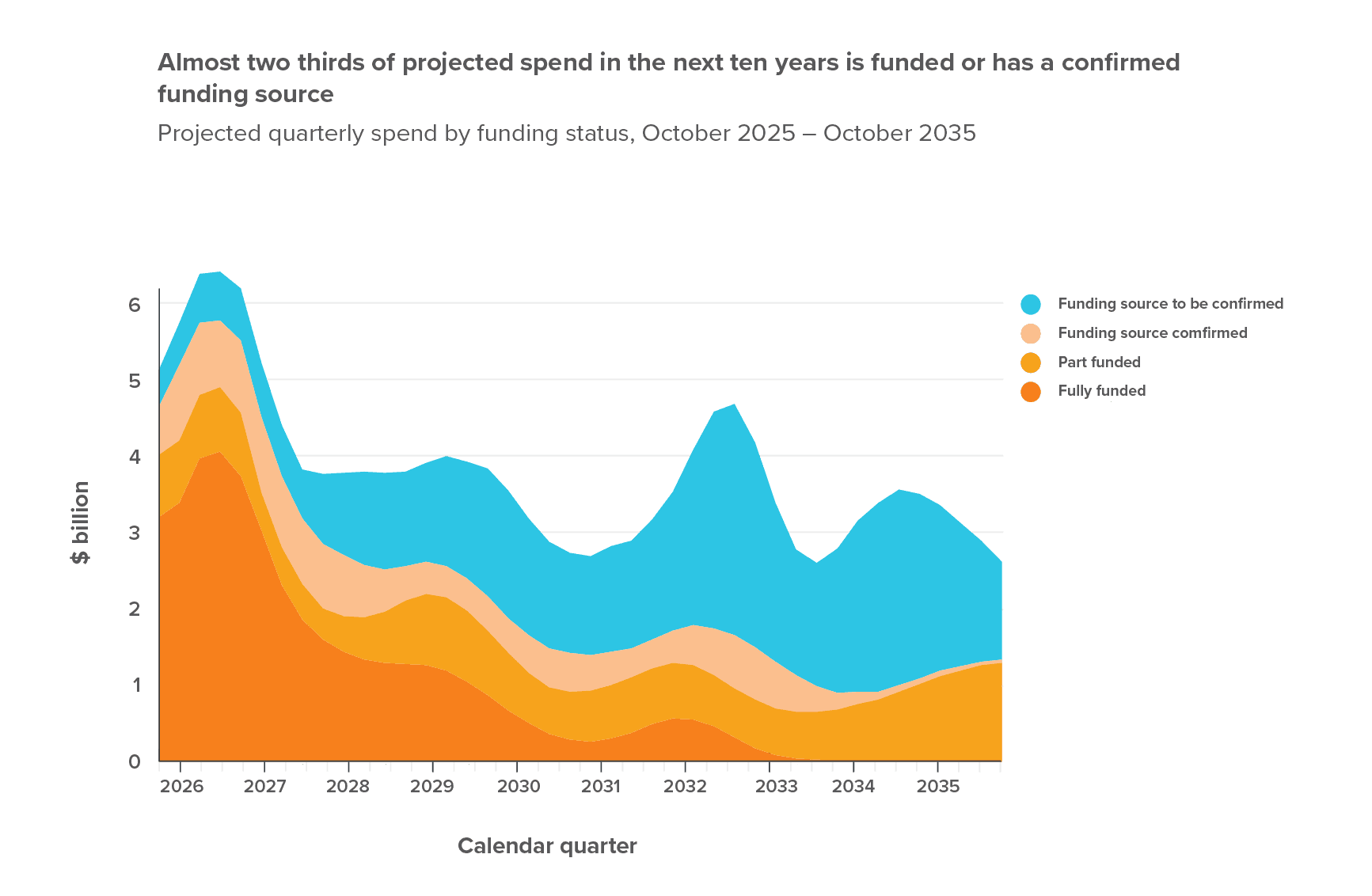

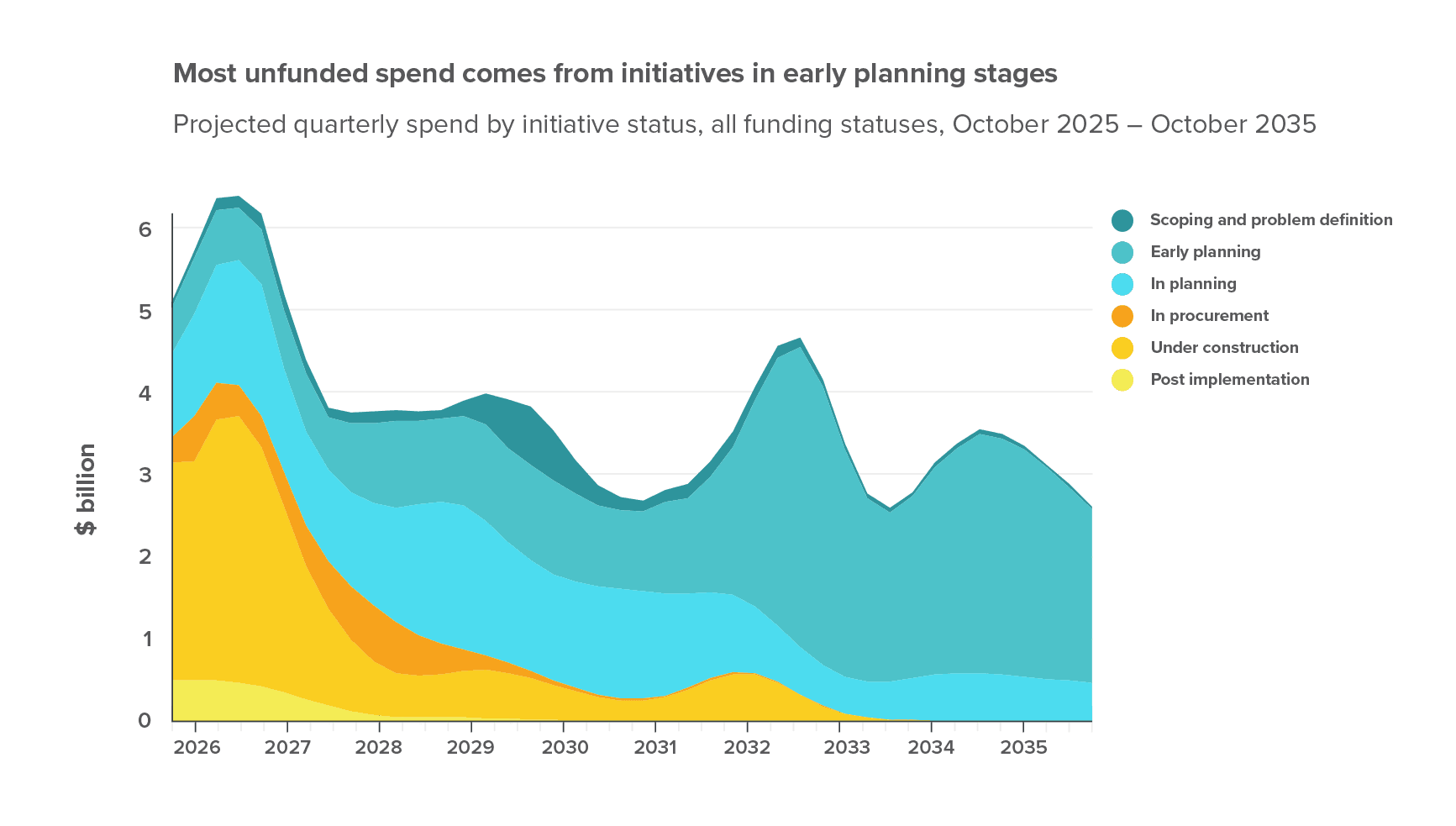

Each quarter we model the projected spend for the delivery of initiatives in the Pipeline. The projections include all Pipeline initiatives regardless of funding status except for initiatives reported as ‘under review’ and ‘on hold’ which have been excluded.

Working with our contributors we continue to improve the visibility of lower-certainty initiatives that are earlier in the planning cycle and are currently unfunded. A more complete Pipeline with a transparent longer-term view of expected activity becomes a powerful tool to support scheduling and assessment of project deliverability in addition to funding and policy decisions.

The September 2025 update shows a total of $20.5 billion in projected spend for current Pipeline initiatives in 2025 across all funding statuses. Commission research indicates over the last 20 years, New Zealand spent an average of 5.8% of gross domestic product (GDP) on infrastructure. The $20.5 billion in projected spend for 2025 equates to around 4.7% of GDP and highlights the completeness of infrastructure activity included in and explained by the Pipeline in the near term.

The projected spend across all funding statuses for 2026 is currently $24.1 billion. Near-term projected spend figures generally rise when modelled each quarter, as initiatives with short planning horizons are planned and submitted to the Pipeline.

Our ten-year projection indicates that for Pipeline initiatives with confirmed funding sources, three quarters of projected spend will occur within five and a half years. This measure provides a benchmark of how far ahead we are making commitments in aggregate across the Pipeline.

Building a stronger forward view

The shape of the spend projections reflects that both transparency of spend and certainty naturally decrease over the planning horizon and varies across infrastructure sectors. Factors such as the relative size of an individual initiative to the size of the market, initiative scope, and initiative complexity influence how far ahead initiatives are typically planned within each sector.

- Figure 3, Projected spend by funding status, shows spend with the relative split of funding commitment over time. Large, committed projects drive spend further forward into the future, while the remainder of projects wait on investment decisions.

- Figure 4, Projected spend by initiative status, for all funding status shows a similar trend to Figure 3 and highlights the improving visibility of lower-certainty initiatives across the planning horizon.

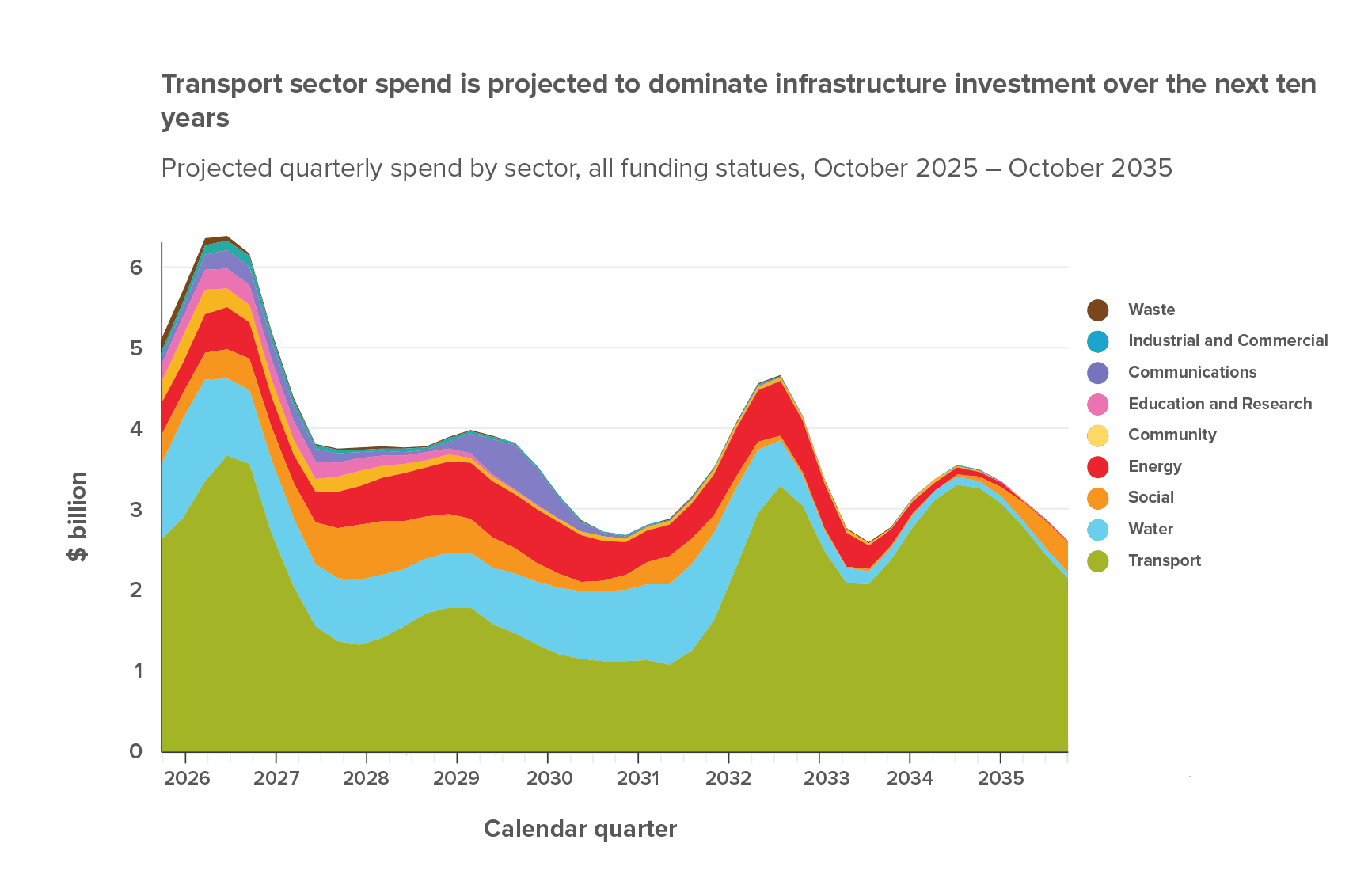

- Figure 5, Projected spend by infrastructure sectors, for all funding status shows the transport sector (including road, rail, ports, and airports) continues to dominate the Pipeline over the next 10 years. In 2025 transport spend accounts for $10.3 billion or 50% of total projected spend. Annual spend for all initiatives in this sector remains above $4.5 billion across the 10-year projection. From 2025–2035 the total projected transport spend is $85 billion or 54% of spend across all sectors. The water sector accounts for $3.9 billion or 19% of projected spend in 2025. Projected annual spend in the water sector fluctuates between $2.6 billion and $4.1 billion between 2025 and 2032 and, based on current submitted information, drops to $0.7 billion in 2033.

The spend projections will continue to evolve as projects are adjusted, scheduled, and completed, new projects are planned and added, and as new contributors provide project information to the Pipeline.

Figure 3

Figure 4

Figure 5

The workforce needed to deliver the Pipeline

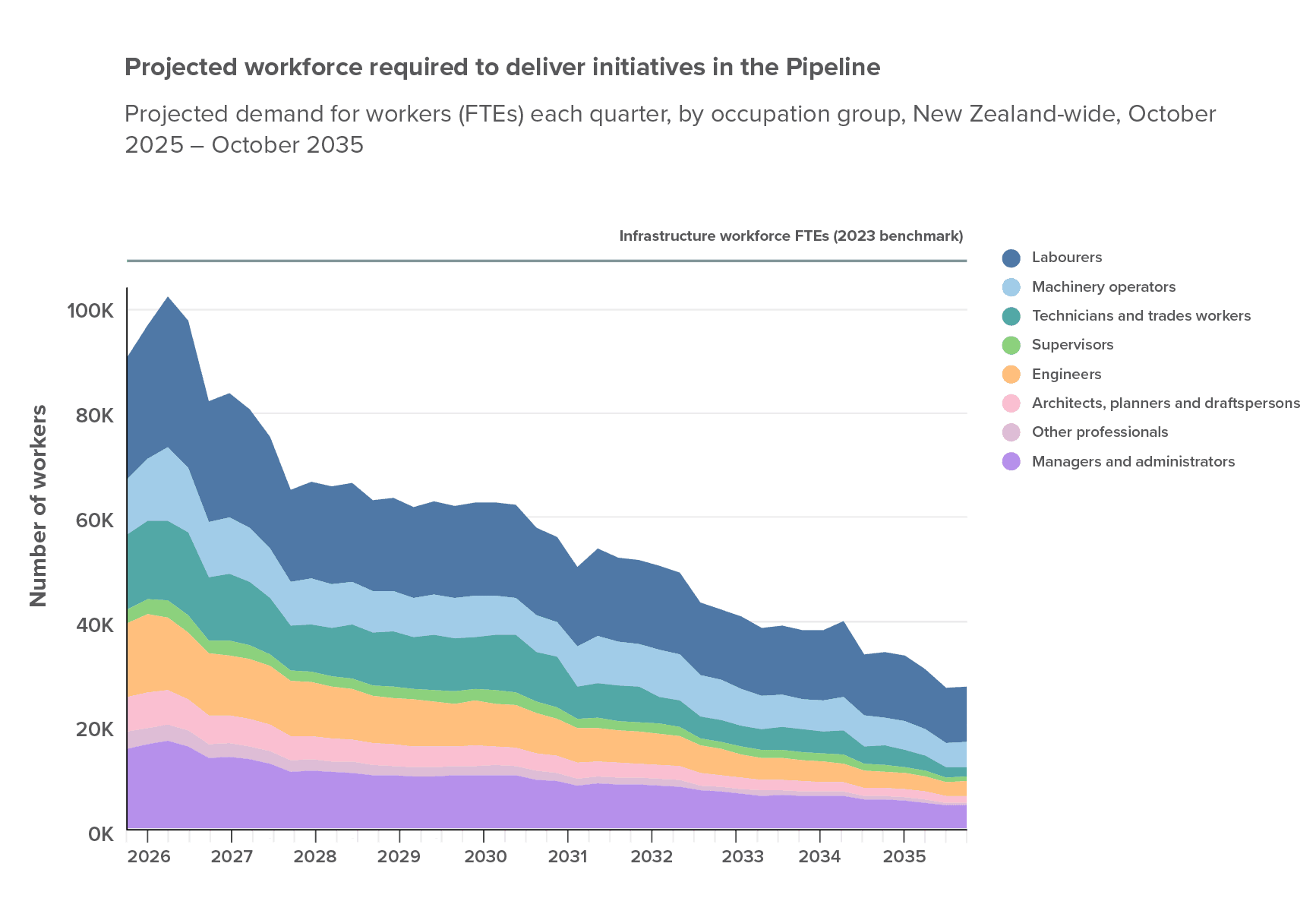

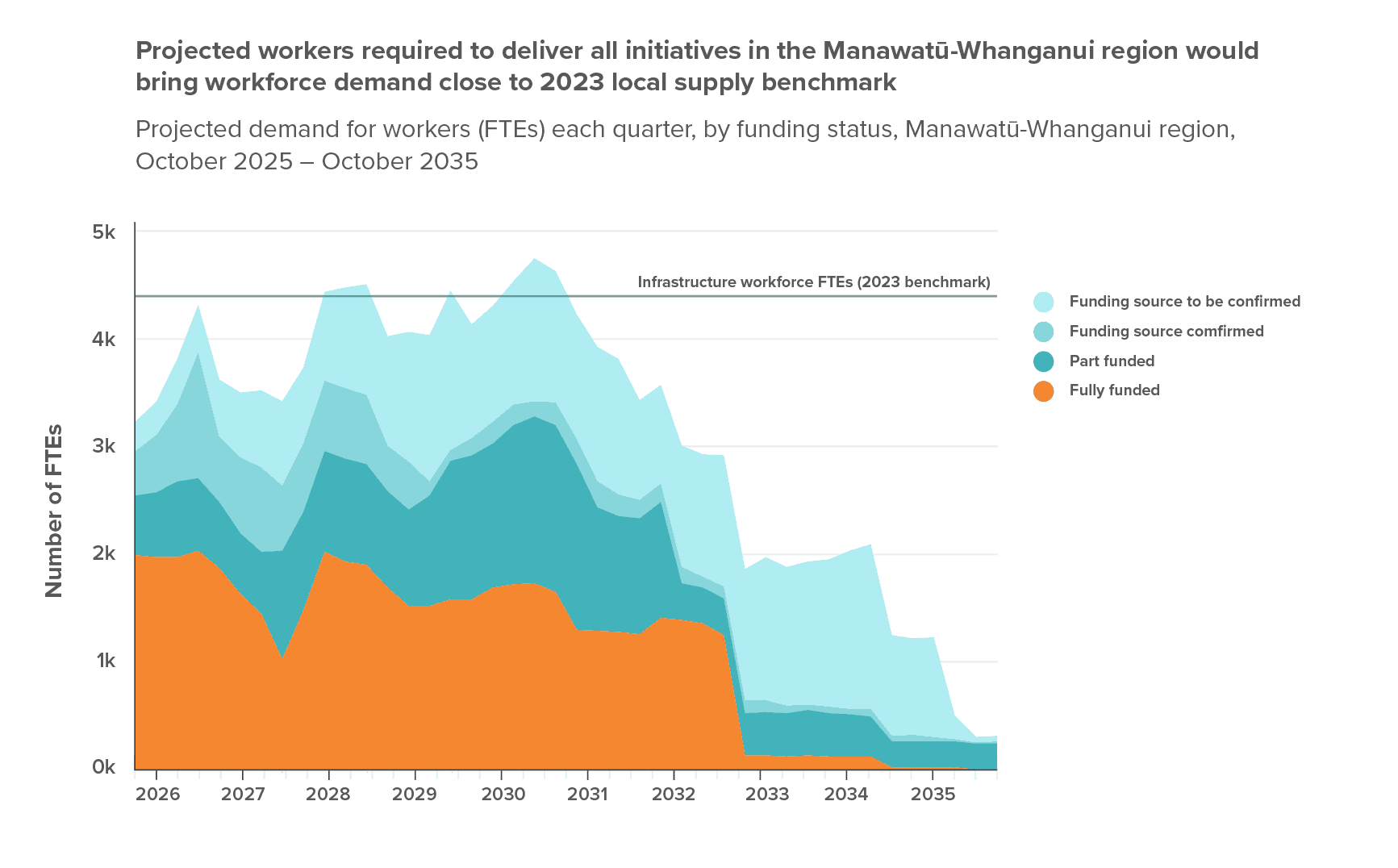

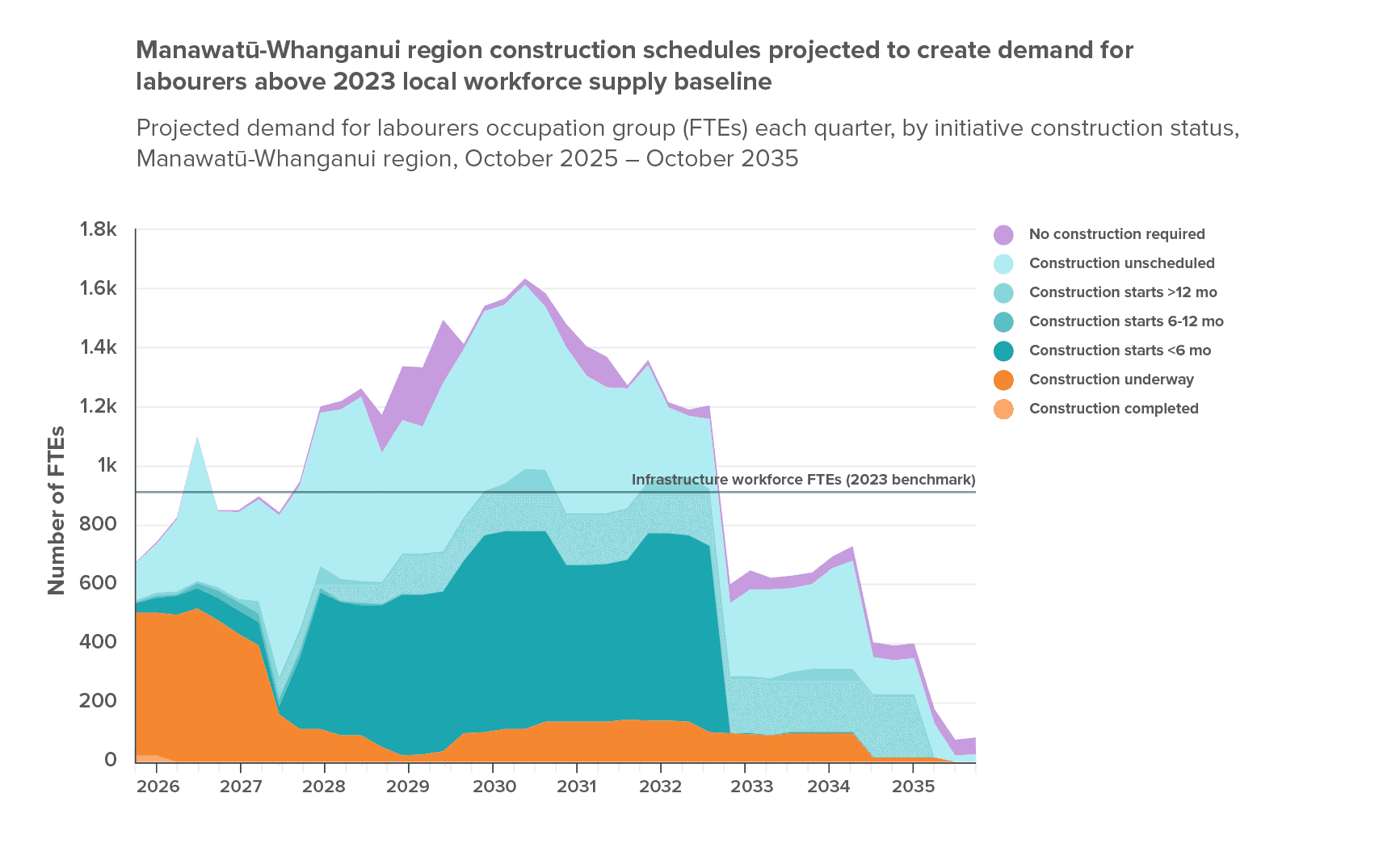

An early view of workforce demand (and measures of certainty) is important for planning, coordination, and scheduling of work. It helps training institutions, the construction sector, and regions to make informed decisions on investments in developing the skills and workforce that will be needed.

The infrastructure workforce is part of the wider construction workforce, much of which is dominated by housing construction activity. Around one third of the construction workforce is employed within the infrastructure sector.

Figures 6 to 8 present different views of the projected infrastructure full time equivalent (FTE) workforce required to deliver Pipeline initiatives4. A 2023 benchmark for the estimated infrastructure workforce size (supply of workforce) is included as a reference. Labour markets are dynamic by nature, and supply will have changed from 2023. However, the 2023 reference line provides a useful indication of where there may be available workforce capacity in the market, or where delivery may become constrained due to excess workforce demand. A gap between the 2023 supply benchmark and forward demand projections does not represent a drop in demand for workers. The Pipeline does not yet cover all infrastructure project activity within New Zealand and as a result, these projections may understate demand.

- Figure 6, Total Pipeline workforce demand by all occupation groups, shows the continued progress in growing Pipeline’s coverage where, in the near term, the demand projections are nearing the 2023 supply baseline in the near term.

- Figure 7, Manawatū-Whanganui region by initiative funding status (an example) shows stable projected demand close to 2023 local infrastructure workforce supply levels out to 2033. However, about half of the activity is recorded without a funding source confirmed at this time. These initiatives are more likely to change as funding and scheduling decisions are made with impacts on the regional scale of workforce demand and when its needed.

- Figure 8, Manawatū-Whanganui region labourers occupation group by initiative construction status (an example) suggests the projected demand for the labourers group is already close to the 2023 capacity for the region, and between 2028-2033 the demand for labourers may become more constrained in the local market.

These projections will continue to evolve as initiatives with shorter planning horizons are added to the Pipeline, existing information is updated, and as initiatives are completed. Follow the chart links below to our insight platform and login to generate more insights for your region, sector or industry.

Figure 6

Figure 7

Figure 8

Drivers of change in value between quarters

Lifting Pipeline contributors’ submission quality

We are committed to working with contributors to improve Pipeline information quality and standardise and align reporting processes. This snapshot is based information received during the September update process compared to June quarter information.

In September we asked contributors to pay careful attention to initiatives’ funding status. Improvements in contributors' September information is one of the reasons for changes in Pipeline value, including a large portion of the increase in the value for initiatives recorded with a confirmed funding source.

Similarly, changes observed through the Pipeline in initiatives’ expected costs, are often driven by a change in approach to reporting to better reflect potential costs for full initiatives, rather than by a change in initiative scope, cost increase or cost escalation.

Since September, initiatives will have progressed further through their project lifecycles. Some significant initiatives such as the NZTA RoNS programme have progressed in commitment or through funding announcements, and this will not be reflected in the analysis below.

Value of initiatives reported with full funding, part funding, or a confirmed funding source increased by $56 billion

Transparent reporting of funding status enables the Commission to build a clearer view of committed investment and provides a more accurate signal to the construction market, of what is being planned, the combined volume of activity, and insights into the relative certainty of initiatives proceeding (for example, funding status).

The net effect of all changes in September was an increase of $56 billion in recorded Pipeline value for initiatives with full funding, part funding, or a confirmed funding source, this is highlighted in Figure 9. While initiatives with part funding or confirmed funding source does indicate clear progression towards funding, it does not guarantee funding will be committed.

Major drivers of the $56 billion increase included:

- $28 billion of initiatives overall progressing from having no confirmed funding source to having a confirmed funding source:

- $1.5 billion progressed to ‘Fully funded’

- $23.8 billion progressed to ‘Part funded’ (NZTA adjustments to the funding status of RoNS initiatives being a major contributor)

- $2.7 billion progressed to ‘Funding source confirmed’

- $16.9 billion of new initiatives with a confirmed funding source being added to the Pipeline:

- $8.3 billion submitted as ‘Fully funded’

- $5.5 billion submitted as ‘Part funded’

- $3.1 billion submitted as ‘Funding source confirmed’

- $17.4 billion increase in the value of existing initiatives that had previously been reported with a confirmed funding source.

- Changes driving the opposite direction and balancing the net change were initiatives that were completed, those reported with a reduction in expected costs, or were updated to 'Funding source to be confirmed'.

Figure 9

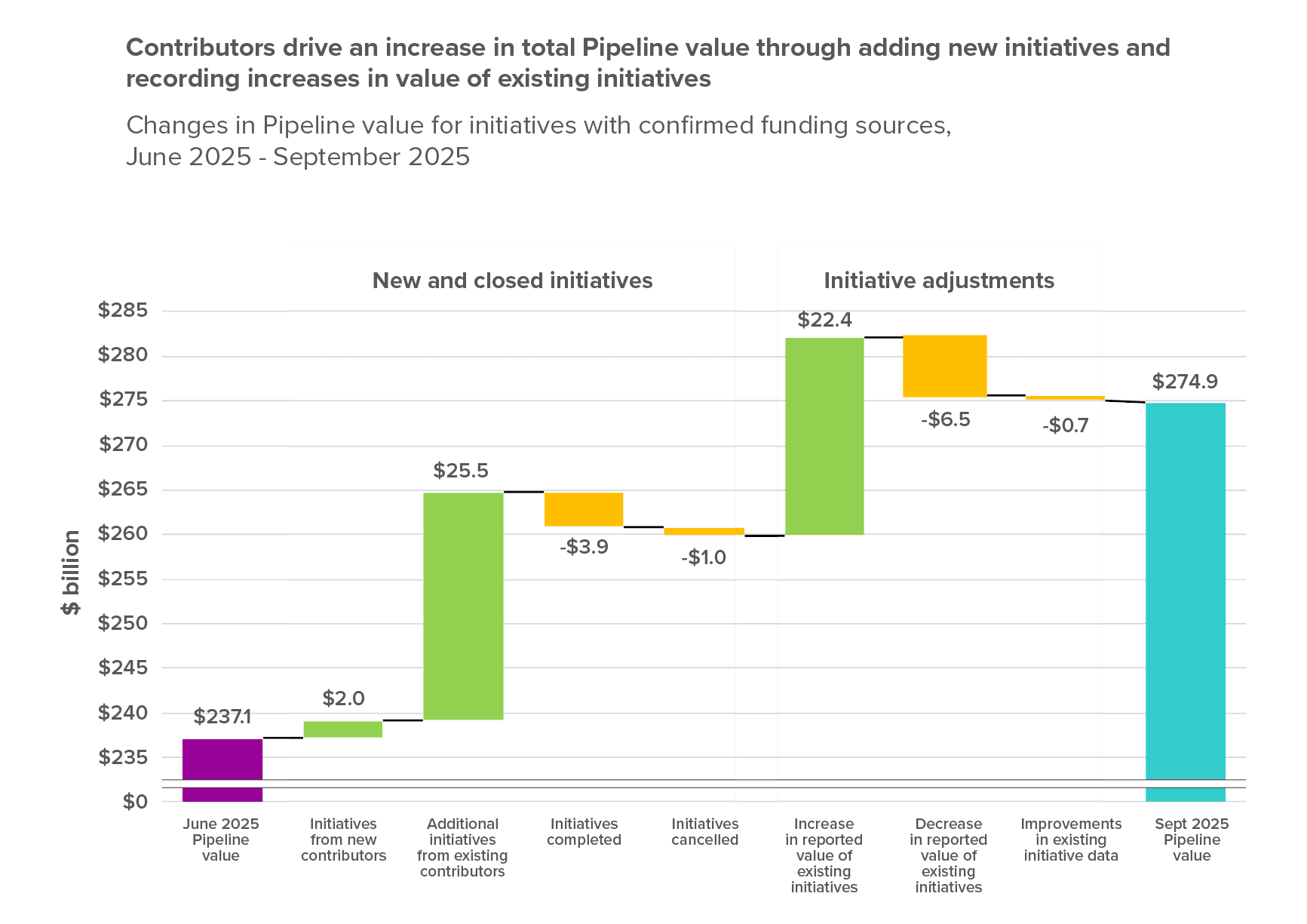

Total value of all initiatives in the Pipeline increased by $38 billion

The total expected cost of initiatives the Pipeline increased from $237.1 billion in June to $274.9 billion in September. The main drivers of change are outlined below and in the Figures.

Increases in total Pipeline value

- $2 billion from new organisations providing information

- $25.5 billion from existing contributors providing additional initiatives

- $22.4 billion from adjustments in the reported value of existing initiatives

Decreases in total Pipeline value

- $3.9 billion from initiatives completed during the quarter

- $1 billion from initiatives cancelled during the quarter

- $6.5 billion from adjustments in the reported value of existing initiatives

- Quality adjustments resulted in a net decrease of $700 million in Pipeline value.

A total of $27.5 billion of new initiatives was added to the Pipeline in September. This included a major update from Watercare, new initiatives from KiwiRail, as well as initiatives submitted in confidence from commercial providers. Adjustments made to previously reported initiatives had a net result of adding a $15.9 billion in Pipeline value.

Figure 10 illustrates the change in total Pipeline value in September inclusive of all initiatives, regardless of funding status, or their progress through the planning and delivery lifecycle.

Figure 10

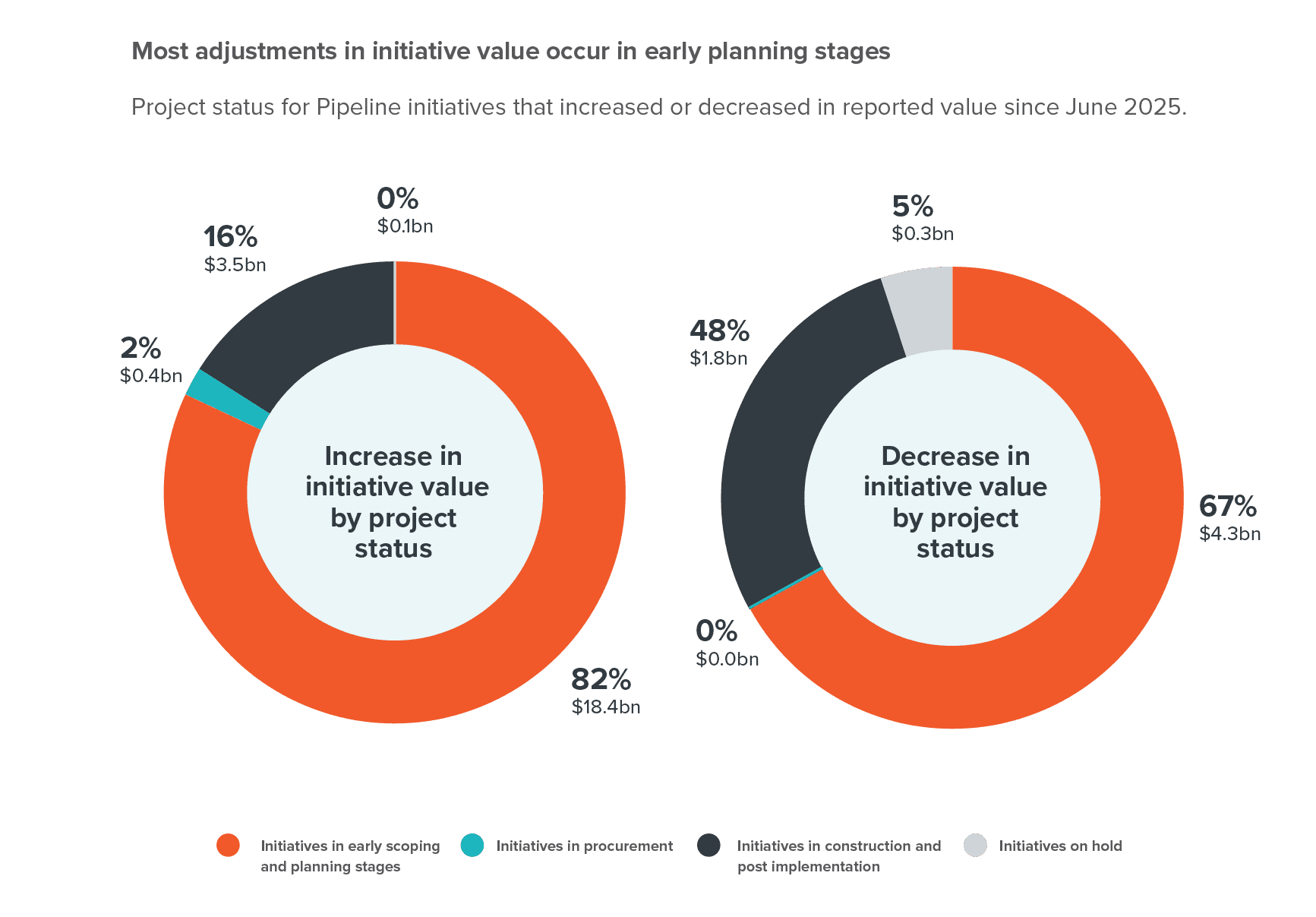

Adjustments to expected costs of initiatives

Figure 11 highlights that changes to the expected cost of initiatives are a large driver of change in Pipeline value. Cost estimates for initiatives in early planning stages are typically lower-confidence. However, these early project stages are also the easiest time to accommodate change to these initiatives.

In the September update, changes to initiatives in early scoping and planning stages accounted for 82% of the $22.4 billion increase in the expected costs for existing initiatives. A further 16% came from initiatives in construction and post-implementation.

Initiatives in early scoping and planning stages accounted for 67% of the $6.5 billion decrease in the expected costs from existing initiatives, while 48% came from initiatives in construction or post implementation stages.

Figure 11

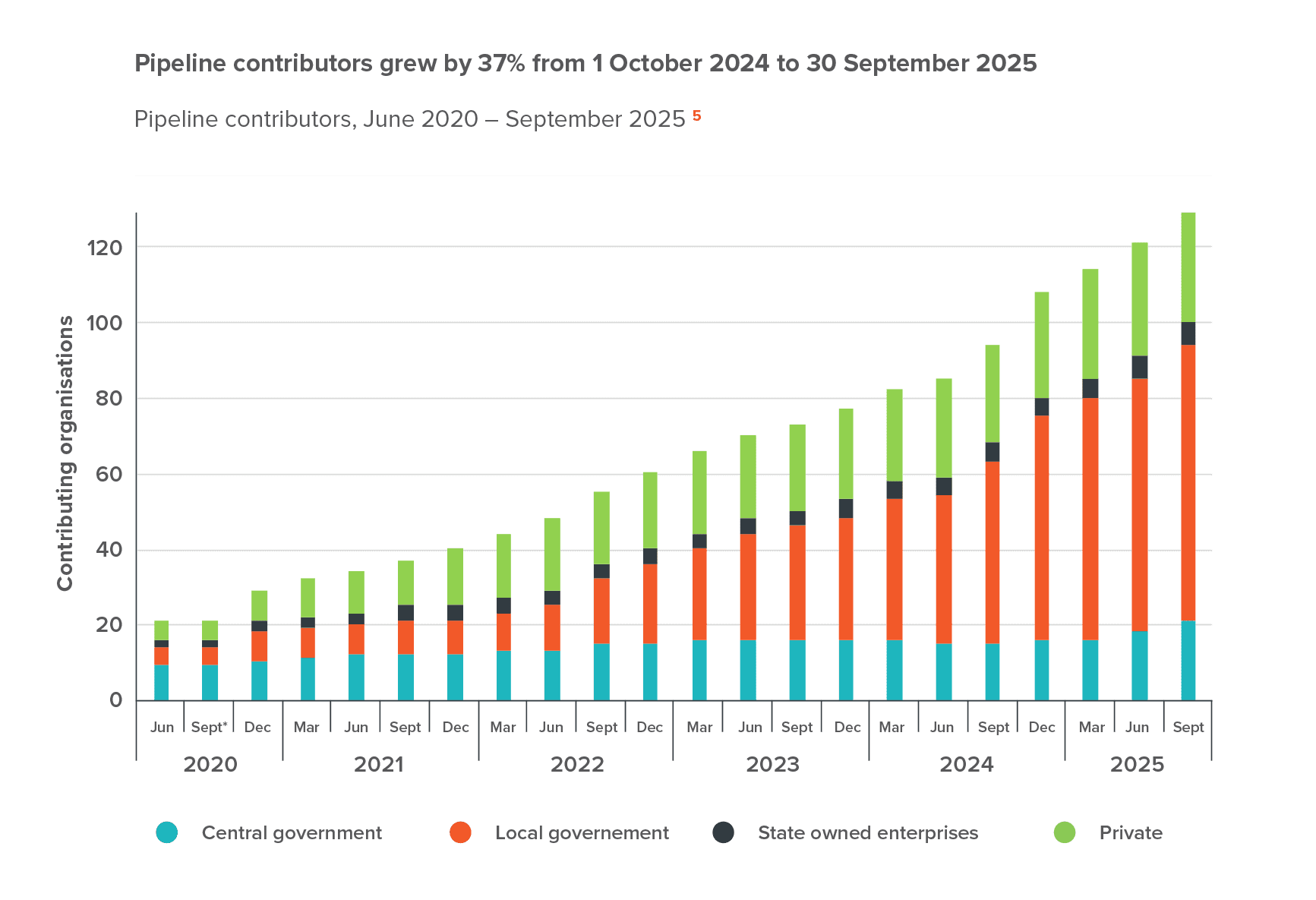

Towards a complete Pipeline

Te Waihanga first published the Pipeline in June of 2020 to support statutory functions required under the New Zealand Infrastructure Commission/Te Waihanga Act 2019. The Pipeline continues to build towards a trusted and complete view of infrastructure investment and activity in New Zealand.

In September, 88% of our contributors provided updates, adding new initiatives, making changes or confirming their information remained correct. In addition to these updates, we welcomed nine new contributors:

- Chatham Islands Council

- Fire and Emergency New Zealand

- Ministry for Culture and Heritage

- Ministry of Foreign Affairs and Trade

- Rangitīkei District Council

- Ruapehu District Council

- South Wairarapa District Council

- Southland District Council

- Taupō District Council

In total, 129 organisations now contribute information, up 37% on 12 months ago. We thank our partners for their efforts and another step change to improving the national coverage of the Pipeline and supporting improved planning and efficiency in the construction sector.5

Figure 12

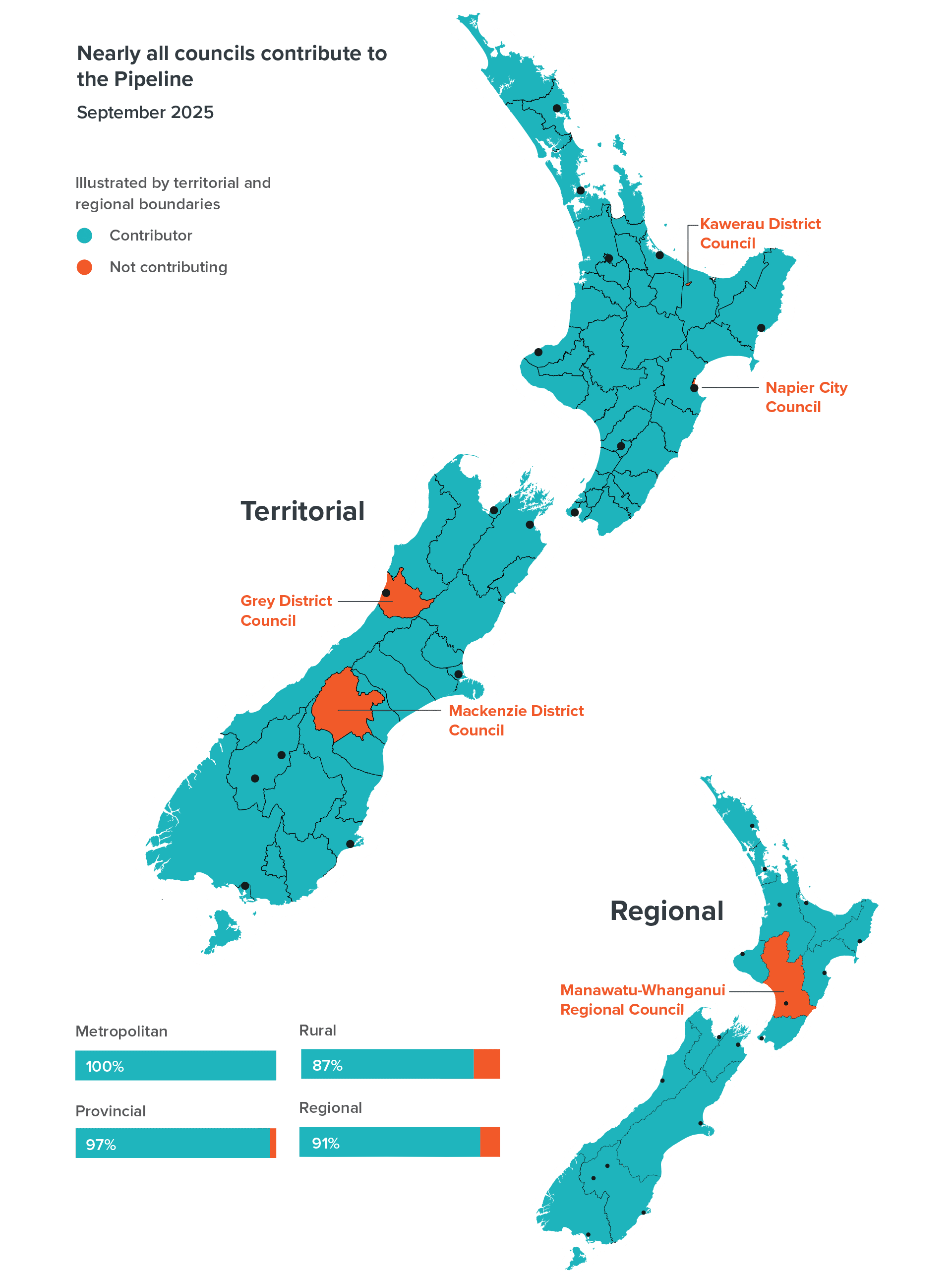

Pipeline contributors include 21 central government organisations, 6 State owned enterprises, 4 electrical lines companies covering 54% of the installation control points (ICPs) 6 and 73 councils (94% of councils across New Zealand), covering 98% of all rate revenue collected. Council contributors are illustrated in Figure 13.

The role of the Pipeline

The Pipeline forms an important evidence base to support a coordinated approach to infrastructure delivery across sectors, regions, and markets. Insights from the Pipeline enable understanding of investment options (and opportunity costs), competing demand for construction resources and workforce, and constraints or opportunities in the market. This understanding is fundamental to promoting efficient investment in infrastructure.

The Pipeline helps inform policy development and the Commission’s advice on improvements to the wider infrastructure system, as well as Government demand-side decisions (e.g. increasing or curtailing demand through funding and other settings), and supply-side decisions (e.g. economic, education, and employment initiatives and settings).

Infrastructure providers use the forward view of infrastructure activity the Pipeline provides to inform prioritisation, coordination, planning, and investment decisions. Our stakeholders within the construction market use the Pipeline to understand upcoming business opportunities and the workforce capability and capacity that will be needed to deliver infrastructure projects. Regional economic and employment agencies use the Pipeline to understand when they need to draw skills to their region.

Join the Pipeline

If your organisation is responsible for infrastructure, and your projects are not in the Pipeline, or you are new in your organisation and want to know more, please contact the Infrastructure Commission and get your projects added and kept up-to-date via pipeline@tewaihanga.govt.nz.

Watch our Introduction to the Pipeline webinar and find out more about the role of the Pipeline, value to your organisation, submission process, and data requirements.

We appreciate your support as we continue to build a complete picture of infrastructure investment and project intentions from across New Zealand.

Where to learn more

Learn more on our Insights Platform where you can gain access to a range of Pipeline insights and tools.

- Search the Pipeline, view estimated timings, and filter by project size, sector, location, and more.

- Download Pipeline information for initiatives that have not been provided in confidence.

- Uncover the workforce and occupations that would be needed to deliver the initiatives Pipeline.

View previous snapshots

Pipeline snapshot: April - June 2025

Pipeline snapshot: January - March 2025

Pipeline snapshot: October - December 2024

Pipeline snapshot - July-September 2024

Pipeline snapshot April - June 2024

Pipeline Snapshot: January - March 2024

Pipeline Snapshot: October - December 2023

Pipeline snapshot: July - September 2023

Pipeline snapshot: April - June 2023

Pipeline snapshot: January - March 2023

Pipeline snapshot: October - December 2022

Infrastructure Quarterly - November 2022

Infrastructure Quarterly - August 2022

Infrastructure Quarterly - January 2022

Infrastructure Quarterly - May 2022

Infrastructure Quarterly - October 2021

Infrastructure Quarterly - July 2021

1. The information release for the September update was published through our online facilitation tools on 30 September 2025.

2. The Pipeline is a live system that is updated regularly. Our snapshot reports are based on best known information at the time of publication. This may cause differences in reported values over time and between publications.

3. Projects submitted with a project status of ‘In procurement’ and projects reported to enter procurement in 12 months from 1 October 2025.

4. Our workforce modelling currently uses a different model to the spend modelling and some differences may arise because of this. Over time we will integrate these two models.

5. In Figure 12 Central government includes Crown entities; state owned enterprises includes mixed-ownership models; private organisations includes council-controlled organisations and universities.

6. An ICP is an installation control point or the point of connection to an electricity network where an electricity retailer is deemed to supply electricity to a consumer.